STRATEGY GUIDE

2026 Full-Funnel Marketing Playbook

Chapter 2: Mid-Funnel: Engagement That Builds Momentum

Awareness starts the conversation, but the middle funnel is where shoppers compare options and form intent. At this stage, consistent visibility keeps your dealership on the shopper’s short list.

While top-of-funnel (TOFU) campaigns introduce your brand, and bottom-of-funnel (BOFU) tactics drive the final purchase, mid-funnel (MOFU) marketing nurtures the crucial middle ground: interest and consideration. This is the phase where shoppers evaluate brands, weigh tradeoffs, and decide which dealers to trust and contact.

Understanding interest and consideration

In the automotive journey, the mid-funnel is the evaluation stage: a small window when undecided shoppers narrow their choices. They have moved beyond general awareness but haven’t yet chosen where or what to buy.

At this stage, visibility isn’t just about showing up — it’s about staying consistent.

Shoppers research, compare, and form preferences based on repeated exposure to dealer names, listings, and ads.

Key traits of mid-funnel marketing:

- Defined intent, but undecided preference. Shoppers are gathering information on models, trims, prices, and local availability, but haven’t chosen a dealer.

- A compressed window of influence. The average shopper spends about 60 days from research to purchase, with nearly half planning to buy within a month and a quarter within two weeks.¹

- High competition for attention. Multiple dealers are targeting the same audience, so consistency and relevance are what keep your store in the conversation.

- Frequency over reach. Research shows it takes 7–8 ad touches before shoppers even recognize a message.²

Where awareness builds recognition and bottom-funnel campaigns close the deal, mid-funnel marketing keeps your dealership top of mind long enough for awareness to pay off.

Busting the myths about mid-funnel

The mid-funnel can be tricky to navigate. These common misconceptions highlight where dealers often misinterpret shopper behavior, and how to approach engagement more effectively.

Myth 1: “A strong CTR alone proves your ads are working”

Reality: Mid-funnel clicks show curiosity, not intent.

Shoppers explore multiple dealers and listings before deciding who to contact. A strong click-through rate signals interest, but it doesn’t mean buyers are ready to act.

What matters is evaluating performance across multiple factors — not just clicks. Consistent visibility, reach and frequency, effective CPM, and measurable post-click actions (via UTM tracking or pixels) all contribute to recognition and trust, ensuring your dealership is top of mind when buyers are ready to act.

Dealer insight: Look beyond clicks to measure performance. Track time on site, repeat visits, and cross-channel engagement. Consistent visibility across marketplace, social, and display strengthens recall and increases the likelihood your dealership is top of mind when it counts.

Myth 2: “Audience size is the most important factor for mid-funnel tactics”

Reality: Mid-funnel success depends on consistency, not just coverage.

Shoppers spend roughly 60 days in-market¹, so visibility needs to be steady, not sporadic. A wide reach introduces your dealership, but without steady frequency, shoppers forget your name among competing ads. The dealers who stay present across the shopper’s journey are the ones remembered when it’s time to buy.

Dealer insight: Use cross-channel campaigns to reinforce your presence throughout the research phase. Cars Social and display campaigns extend awareness efficiently, keeping your dealership visible from initial research through comparison.

Myth 3: “Any in-market audience is good enough”

Reality: Not all intent signals are equal, and most shoppers are still undecided.

Some providers sell probabilistic audiences — guesses based on indirect signals or outdated third-party data. Deterministic audiences are different: they’re based on real actions. If a shopper searches for a Honda Pilot on Cars.com, you know they’re in the market for that vehicle.

Freshness matters. Probabilistic audiences often combine delayed data sources, like DMV registration records, which can be 45–90 days old. By the time you act on those signals, the shopper may already have decided. Cars.com refreshes deterministic audiences daily and removes unengaged users, so your campaigns reach active, real buyers when it matters most.

Dealer insight: 91% of Cars.com shoppers haven’t chosen a dealer, and 73% are still deciding on make and model.³ That makes marketplace audiences particularly valuable for influencing undecided buyers.

How mid-funnel marketing drives conversion

The mid-funnel isn’t where most leads are captured, but it is where most opportunities are created

Staying visible during research and comparison is like putting up a billboard for your dealership on a busy road: your message claims prime ‘real estate’ in shoppers’ minds. When they think about buying, your dealership is top of mind — making it far more likely they’ll choose you when ready.

Dealers who maintain mid-funnel visibility typically see:

- Higher-quality traffic from shoppers already familiar with their name or listings.

- Increased lead-to-sale rates due to built trust and reduced friction.

- Improved ad efficiency at the bottom of the funnel, since BOFU campaigns no longer have to work as hard to convert cold audiences.

Mid-funnel best practices for dealers

Strong mid-funnel marketing bridges the gap between exposure and action. Here’s how to make it work.

Stay top of mind, not top of feed

Consistency outperforms frequency spikes. Instead of bursts of activity followed by silence, maintain a steady, relevant presence. That familiarity builds trust, making your name feel reliable when decision time comes. Mid-funnel is about focusing on the who, not just the when.

- Prioritize audience planning over purely tactical buys. Target the right shoppers, those actively researching or recently showing interest, rather than casting a wide net. Understanding the who ensures every impression is meaningful.

- Maintain cross-channel visibility: marketplace, social, display, and video (CTV/OTT/OLV). Frequent impressions across devices and formats keep your dealership top of mind as shoppers move through research. Video, especially CTV/OTT/OLV, efficiently scales impressions, focusing spend on in-market audiences rather than broad, untargeted TV buys.

- Refresh creative to reflect seasonal models, offers, or local demand. Keep messaging relevant and timely across channels, including CTV and OTT, to reinforce recognition while staying efficient with media spend.

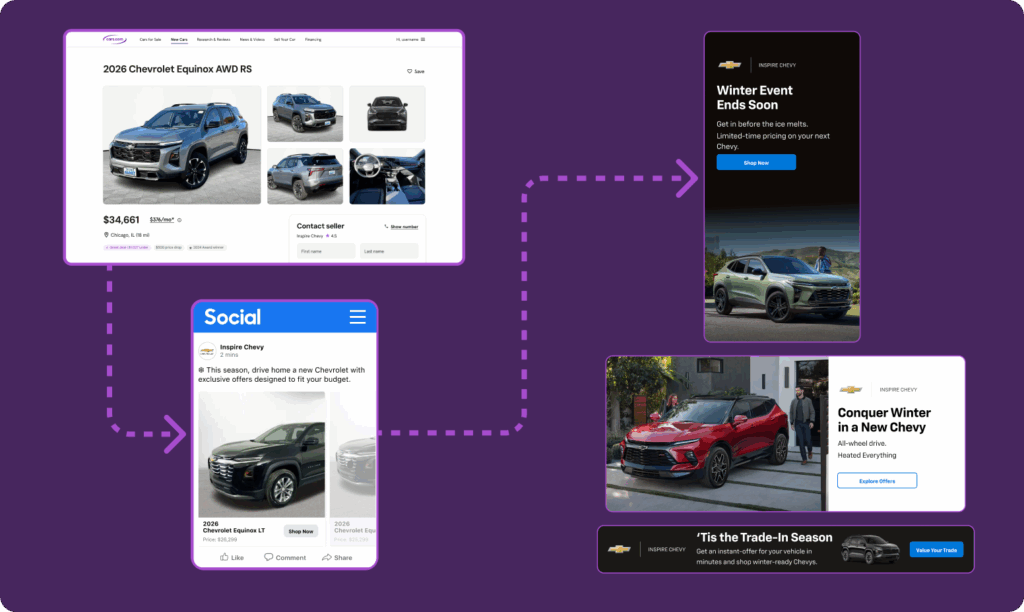

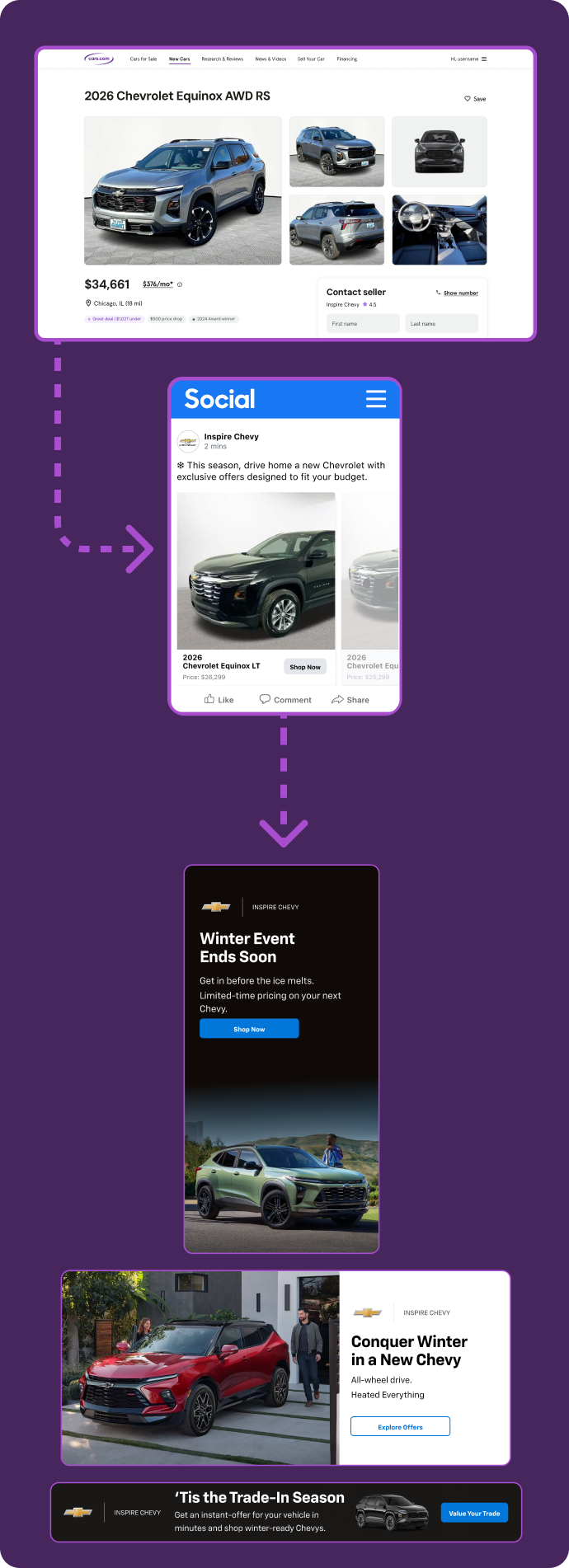

- Use sequencing to tell a story across campaigns. Don’t just repeat the same message. Leverage digital ad partners to sequence creative deliberately, guiding shoppers from awareness to consideration with a cohesive story.

Connect marketplace visibility with paid reach

Mid-funnel impact grows when organic and paid visibility reinforce each other. Shoppers who visit your marketplace listings are already showing interest, so extending your presence to Cars Social and Cars Display helps you reach them across the places they research. Sequencing creative ensures each touch builds on the last, guiding shoppers through their evaluation journey.

- Retarget marketplace audiences across Meta and Google Display. Start with an initial display ad on Cars.com, then follow up with a second touch, like a video ad, for shoppers who have already visited your site.

- Use Cars Commerce first-party data to reach real, undecided buyers rather than modeled lookalikes, keeping your campaigns focused and efficient.

- Align creative across listings and ads to strengthen message recall and reinforce each message in the sequence, so every touch contributes to building recognition and preference.

Measure what matters most: engagement

At the mid-funnel, success is defined by meaningful interactions, not raw clicks.

Track these key metrics:

- Repeat visits or saved listings.

- Interaction with pricing tools or financing calculators.

- Cross-device return activity (mobile to desktop).

Dealer insight: When mid-funnel KPIs rise, lead costs often fall later. Awareness and engagement lift purchase efficiency even if attribution systems don’t immediately show the connection.

Building momentum through the mid-funnel

Mid-funnel marketing is where awareness transforms into intent — the critical phase that connects early visibility to final conversion. Dealers who stay present maintain shopper interest and turn recognition into preference that drives action.

Consistent mid-funnel interactions keep your brand part of the decision-making process. Shoppers who repeatedly encounter your dealership during research are more likely to return, engage deeply, and convert efficiently.

Cars Commerce Media Network strengthens this connection by helping dealers:

- Reach verified marketplace audiences as they move from discovery to consideration.

- Reinforce brand perception through cohesive social, display, and VIN-level campaigns.

- Deliver incentive-based video messages to shoppers who have already visited Cars.com, reinforcing “why buy” messaging and relevant offers to drive low-funnel actions across devices (CTV/OTT/OLV) and audio channels (streaming podcasts).

- Link engagement metrics and marketplace activity to downstream sales performance.

Full-funnel success depends on how each stage supports the next. Connect data, creative, and channels to carry momentum from awareness to conversion.

What’s next: Chapter 3 —

Bottom funnel: closing the sale

Awareness and consideration are just the beginning. In Chapter 3, we’ll explore how bottom-funnel tactics, including retargeting, search, and inventory-driven campaigns, drive the final purchase decision.

Engage shoppers where it matters

Stay visible as shoppers compare options. Cars Commerce Media Network helps you maintain consistent presence across marketplace listings, social, and display campaigns, keeping your dealership in the shopper’s consideration set.

1 Cars Commerce Consumer Metrics Study, Q2 2025

2 Microsoft Advertising, Oct 2024

3 Cars Commerce Consumer Metrics Study, Q2 2025