EXPERT ARTICLE

The appraisal rule that’s

transforming dealer profits

Used cars are your most valuable inventory — bringing in hundreds of dollars more in average front-end gross profit compared to new vehicles. And with tariffs squeezing new car margins and rising prices driving demand for constrained used inventory, getting more trade-ins has never been more critical.

The two largest national used car retailers account for just under 3% of all used cars sold in the U.S. But here’s the kicker: they acquire 13% of used vehicles from consumers — more than 2 million cars a year.1 They’re buying more than they’re selling, then moving the excess inventory through wholesale channels (where dealers end up buying them back at a markup).

Their secret? Making it ridiculously easy for customers to appraise their cars and get instant offers. It’s time to level the playing field by integrating appraisals into your everyday process and getting your entire team involved.

The rule: appraise twice as many as you sell

When dealers hit a 2:1 appraisal-to-sale ratio, three things happen:

- Trade capture jumps from 34% to 53%2

- Missed trades to competitors drop by 50%2

- Gross profit per vehicle increases by up to $2,7003

But here’s what most dealers miss — every unappraised vehicle costs you twice: once when you lose the trade, and again when you pay auction fees and transport costs to replace that inventory.

Appraising 2x more cars than you sell boosts your capture rate above 50%, decreasing reliance on auctions.

Appraising 2x more cars than you sell boosts your capture rate above 50%, decreasing reliance on auctions.

Getting a steady stream of acquisitions from appraisals reduces your reliance on traditional wholesale auctions and their associated fees. Considering the numbers, it’s no surprise that leading dealers are focusing on revamping their customer appraisal acquisition strategy.

The vehicles your customers arrive in are your best profit opportunities. The more vehicles you appraise, the more trades you win — and the more gross profit you generate.

The real hurdle: excuses, not execution

Despite national retailers winning the trade-in game by appraising everything, many dealers stop short of appraising everything that rolls onto their lot.

While 70% of car shoppers have a trade-in, the average trade capture rate for franchise dealers is only 34%.4 But why the disparity?

I hear the same three objections at every 20 Group:

1. “I want to see if I can steal it for less.” (Translation: I’d rather gamble than guarantee profit.)

2. “Customers aren’t telling me the truth about the condition.” (Translation: I don’t trust my process.)

3. “Reconditioning costs scare me.” (Translation: I’m guessing instead of knowing.)

But the numbers don’t justify the concerns, especially when you have the right strategy and appraisal tools in place.

Other dealers may understand the value of appraising every vehicle, but the entire team doesn’t fully buy in or consistently execute. Or, a manager may think they need to touch every appraisal, which prevents more appraisals from happening.

These objections are costing you money every single day. But they don’t have to.

Are you winning the appraisal game?

How your store approaches appraisals today could be the difference between protecting margins and giving them away.

Leading dealers:

- Treat every arrival as an appraisal opportunity

- Involve service departments in sourcing trades

- Consistently achieve 2:1 appraisal ratios

Trailing dealers:

- Still “eyeball” trade values

- Rely on costly and outdated wholesale channels

- Wait for “perfect conditions” instead of executing now

5 steps to appraise every arrival

A 2:1 appraisal-to-sale ratio is your goal. Getting there is a process, not a switch you flip. These five steps will get your team there systematically, building momentum and buy-in along the way.

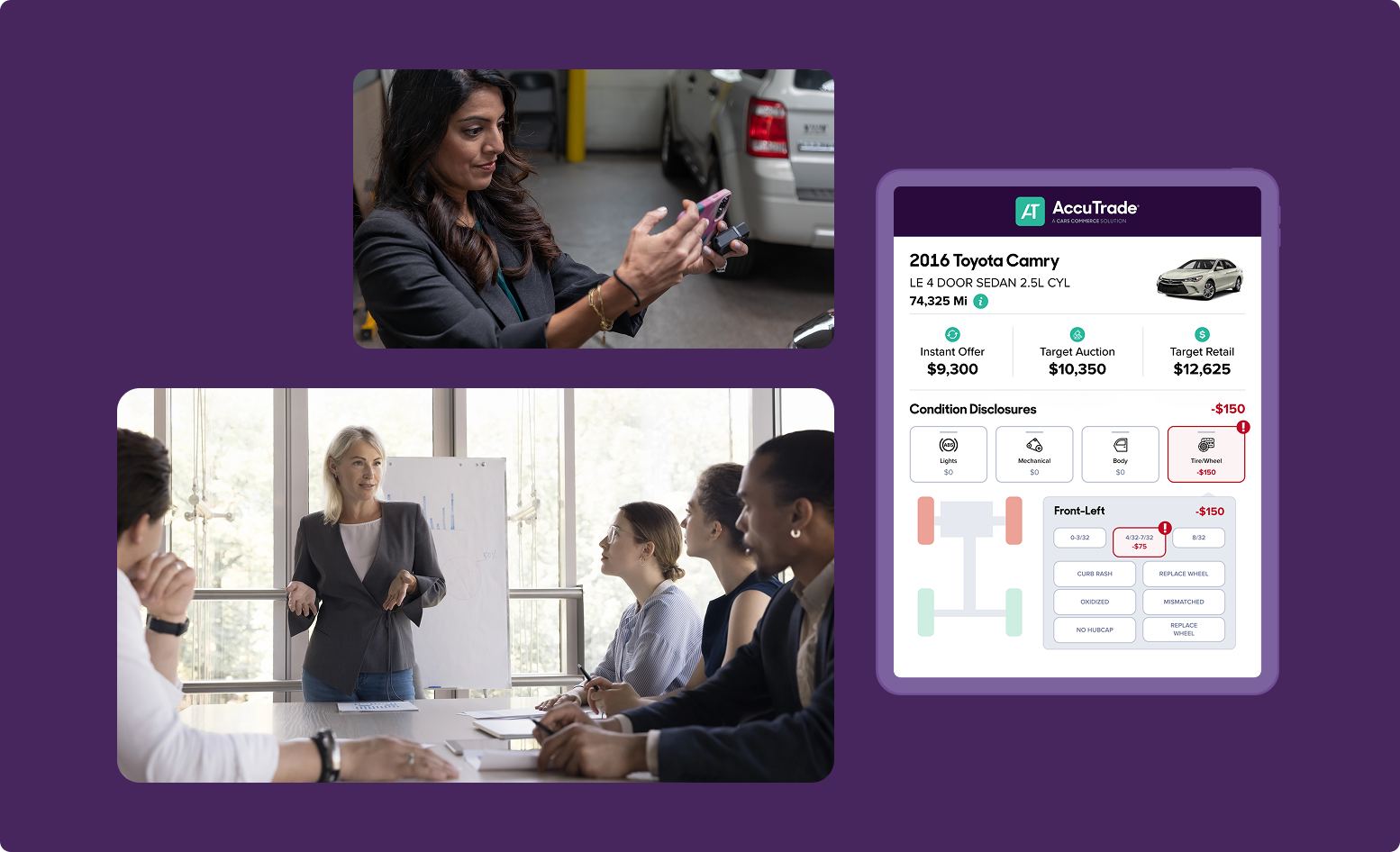

1. Overcome objections with data

Start by getting everyone on board — from managers and salespeople to service advisors and internet teams. The data makes the case for you.

When you appraise a vehicle, you’re 50% less likely to lose that trade-in to another dealer. This applies both in-store and to the driveway appraisals that national retailers consistently win.

The message: Trade-in marketplaces are winning customers with convenient and transparent appraisals — and you can too.

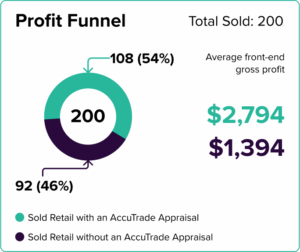

How Profit Funnel reports can help

With AccuTrade’s Profit Funnel reports, you can show your whole team that your dealership is no exception to the overall market data. This report shows how much front-end gross profit you’re making on appraisals vs. those that weren’t appraised.

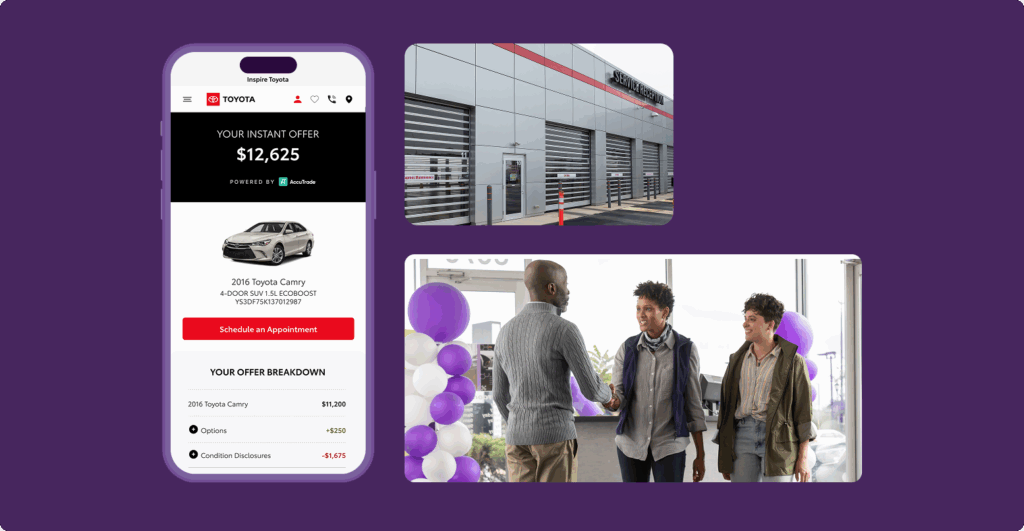

2. Streamline your digital trade-in experience

Trade-in marketplaces are winning because they seamlessly connect the online and in-store experience. They appraise everything and capture even more potential profit by never passing up an opportunity.

Compare your website experience to these digital disruptors. Can customers get an instant offer online? Is your trade-in process as smooth as theirs? Identify gaps and start to narrow them. The easier you make it for customers to get appraised, the more trades you’ll capture.

3. Make it mandatory, make it easy

The new rule: “If it rolls on the lot, it gets appraised.” No exceptions. No manager approval needed.

To hit your target of appraising twice as many vehicles as you sell, you need to make everyone in your dealership an appraiser. You can’t realistically appraise every car yourself, so delegate it to your team.

Make it clear that asking “Would you like to know how much your car is worth?” is as easy as any other customer interaction. When it’s required but simple, adoption follows.

The AccuTrade edge

AccuTrade provides a simple and repeatable way for your entire team to appraise vehicles with confidence. In five minutes or less, you get the complete picture of each vehicle’s true value — eliminating the two biggest profit leaks that kill dealer margins:

- Valuable variances like color, trim, and mileage

- Recon costs for diagnostic issues (avoid $715 per issue with OBD-II scanner5)

With the industry’s most accurate appraisal tool in their hands, your staff can make consistent, data-backed decisions that protect margins and keep deals moving without delays.

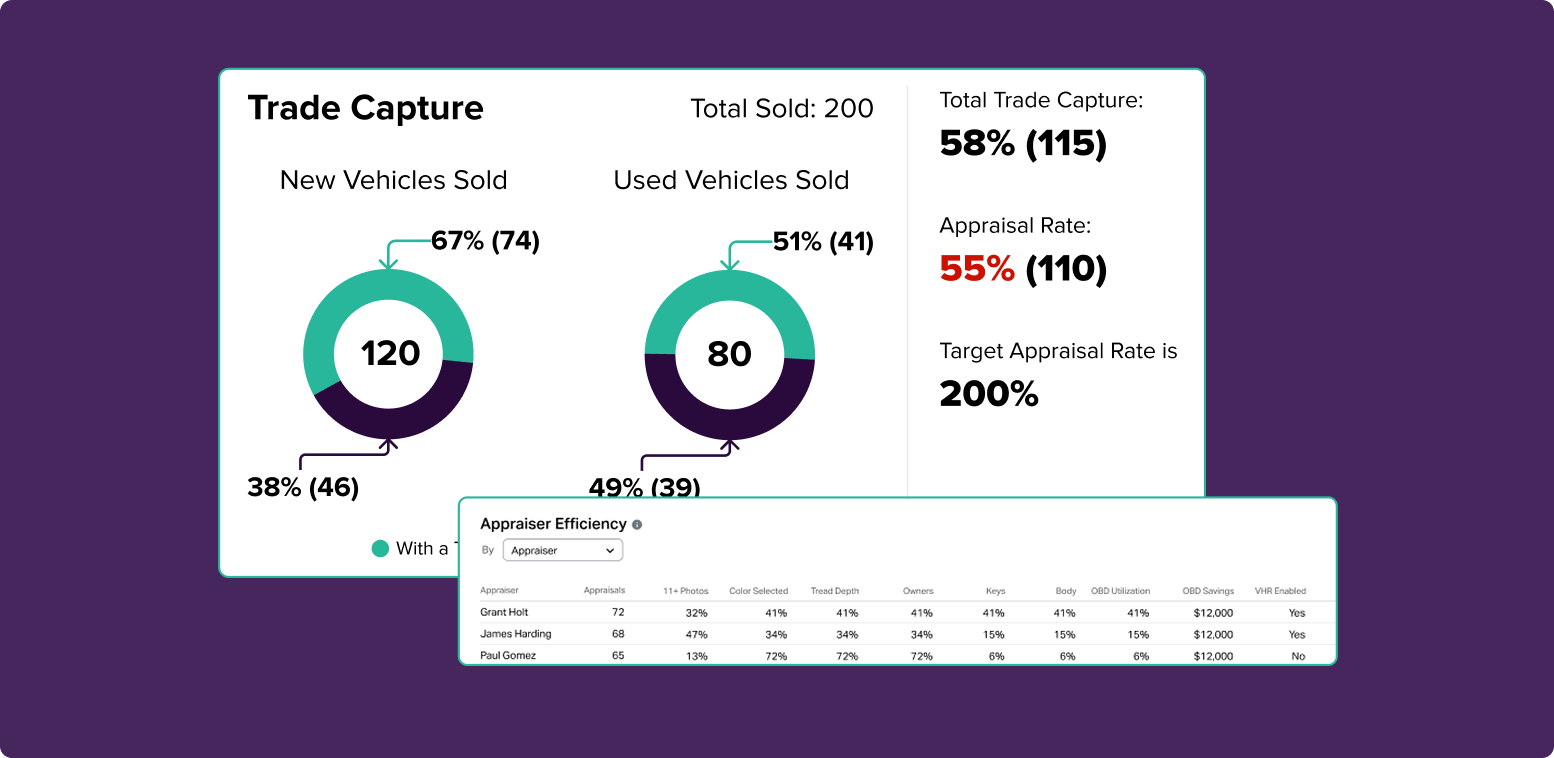

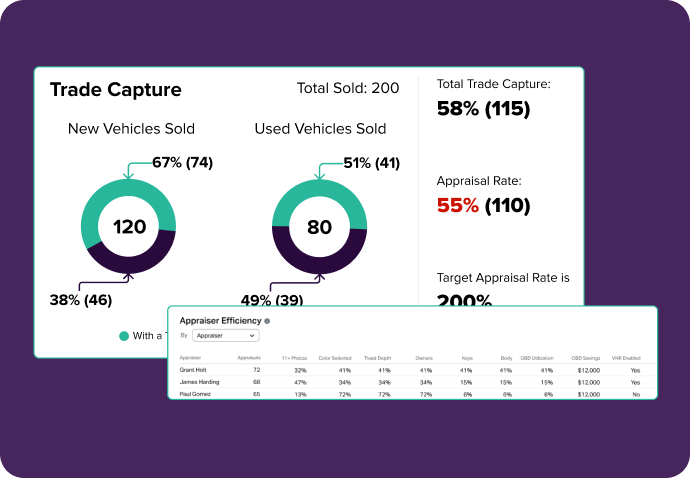

4. Track your progress

What gets measured gets done. So don’t just empower your team to do appraisals — track their progress. AccuTrade has built-in reports that let you monitor appraisal and trade-capture rates by department and employee.

Share weekly results to build accountability: “We appraised 20 more vehicles last week and saw gross profit rise by X. Here’s where it came from,” or “We missed 15 appraisals yesterday. Here’s the profit we left on the table.”

5. Reward performance

Motivation isn’t just about telling someone to do something — it’s about rewarding their behavior. You can reinforce your goals by rewarding the entire company if they hit the 200% appraisal goal, or give them an even bigger reward by hitting 250% or 300%.

Plus, you can add an element of friendly competition by giving recognition + a bonus to the individual/department with the highest appraisal rate. This provides even more motivation for your employees to appraise as many cars as they can.

The cost of waiting

Every month you delay implementing this strategy:

- The largest national retailers capture more of your market

- Your dependency on outdated acquisition channels grows

- Aged inventory cuts into margins

- Your team normalizes losing trades

This isn’t a problem that fixes itself. It’s a problem that compounds.

But the solution isn’t complicated. Your competition is already doing this. So get your team bought in, get your processes locked down, and get every arrival appraised.

Your used car profits depend on it. Your competition is counting on you not to figure this out.

Simplify appraisals and maximize

gross profit on every trade-in

Winning back trades doesn’t require gimmicks — just consistent execution. By making appraisals mandatory, easy, and measurable, you can outpace disruptors and protect your margins.

Let’s connect and we’ll show you how to turn every customer interaction into a profitable acquisition opportunity.

1 Car Dealership Guy, August 2025

2 Cars.com Study, Q1 2025

3 Calculated savings from Auction fees, transport, OBD loss avoidance and recon

4 Consumer research + industry trends, July 2025

5 AccuTrade Dealer Engagement Reporting, 2024