EXPERT ARTICLE

Managing inventory by risk: A practical

guide to maximize front-end gross

Market volatility has exposed how fragile margins can be when you’re managing inventory based on time. External forces like tariffs, regional demand swings, sudden MSRP changes, and reconditioning costs made it clear that vehicle age alone doesn’t define risk or value. Dealers who relied on traditional 30/60/90-day buckets watched inventory depreciate faster than their systems could adapt.

Industry data paints a stark picture: At the end of 2025, used-car wholesale values declined 3.4% quarter over quarter, with EVs dropping even harder at 10.4%.1 Margins are tightening, market volatility is increasing, and dealers who continue managing by age instead of risk are leaving serious money on the table.

Traditional inventory management processes still measure success by age and turn rate, but time-based metrics ignore real market dynamics — VIN-level condition, demand shifts, local inventory shortages, and profitability indicators. This forces dealers into reactive pricing and exit decisions that cut into margin.

The dealers set to win are adopting risk-based inventory management. They’re using real-time insights to identify high-risk vehicles early, price with precision, and align every unit to today’s market conditions. By combining risk-based thinking with complete VIN-level visibility, forward-thinking dealers are escaping the race to the bottom and protecting front-end gross.

The good news? Making this shift doesn’t require a complete overhaul. The key lies in transforming three critical pillars of your operations: people, performance, and process.

People: Build a team that thinks in terms of risk

Your team is the foundation of your inventory strategy. The best data in the world won’t deliver results if your people aren’t equipped to make smarter, faster, more confident decisions based on what the market is actually telling them. Ensuring that everyone thinks in terms of risk requires continuous training, accountability, and effective communication.

Start by teaching managers and appraisers how to interpret risk metrics and market velocity, not just price guide averages. What factors actually impact a vehicle’s profitability? Walk through specific examples: a clean history report versus accident disclosure, high local demand versus oversupply, diagnostic issues that inflate recon costs. When your team understands how these elements combine to create risk profiles, they can make acquisition and pricing decisions that protect margin from day one.

Pro tip: Hold weekly 30-minute training sessions focused on a single risk factor — one week it’s understanding days of supply in your market, the next it’s how mileage impacts depreciation curves differently by segment. The consistency builds competency over time.

Establish clear ownership for appraisals, pricing, and aging inventory to ensure consistent follow-through.

For example:

- Who’s monitoring appraisal rates and performance?

- Who’s responsible for reviewing at-risk vehicles daily?

- Who owns the decision to adjust pricing or move a unit to wholesale?

When accountability is clear and backed by objective data, your team can act faster and with greater confidence.

AccuTrade helps you create accountability with reports that track appraisal and inventory metrics, including:

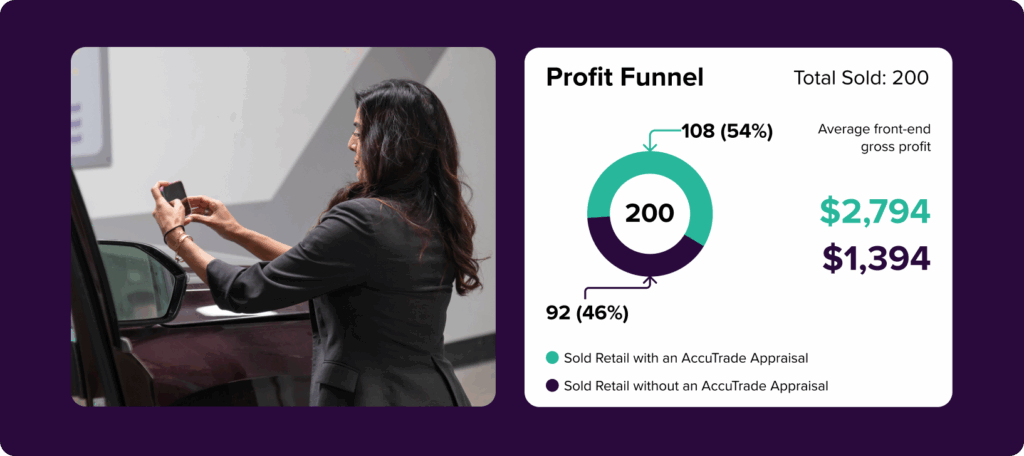

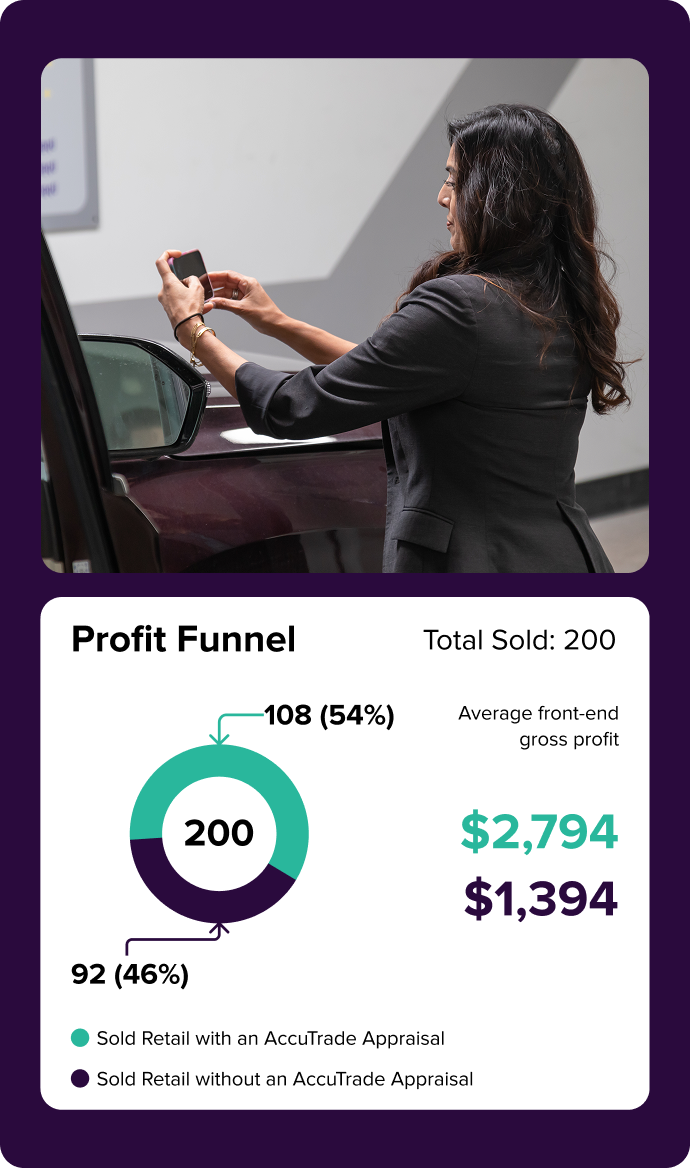

- Profit Funnel Report — Shows your dealership’s average front-end gross profit for vehicles appraised with AccuTrade vs. those that weren’t*

- Trade Capture Report — Shows how effective your team is at appraising vehicles and capturing trades

- Inventory Intelligence Report — Shows a complete risk profile for all vehicles in your inventory

Your sales team needs value-based conversations to overcome shopper objections about vehicle pricing and trade-ins. When your team understands why a vehicle is priced where it is (backed by transparent, VIN-specific data), they can confidently communicate value to customers. This is particularly critical for trade-in negotiations, where transparency builds trust while protecting your acquisition costs.

When negotiating a trade-in, walk them through how you use objective real-time market data to generate the offer, including a diagnostic scan that checks for any issues that affect value. If they mention getting a higher offer online, point out that it may not be using the latest market data or taking recon costs into account. When your projected profit margins are clear in advance, it’s easy to see exactly how much wiggle room you have to raise the offer if needed.

Performance: Measure what actually drives profitability

Think of your inventory like a portfolio of investments. Each VIN has a unique market trajectory, and profitability depends on how and when you act. Time alone can’t guide those decisions.

Measuring inventory performance by age and turn rate worked in stable markets, but today’s volatility demands a different approach. It’s time to shift the focus from volume and velocity to profitability and risk. Here’s how.

Replace time-based goals with performance metrics tied to risk and return. Instead of celebrating a 45-day average turn, start tracking how many units you’re moving out of high-risk categories before they burn margin. How many vehicles are you pricing to market within 48 hours of acquisition? How often are you catching condition issues before they become expensive surprises?

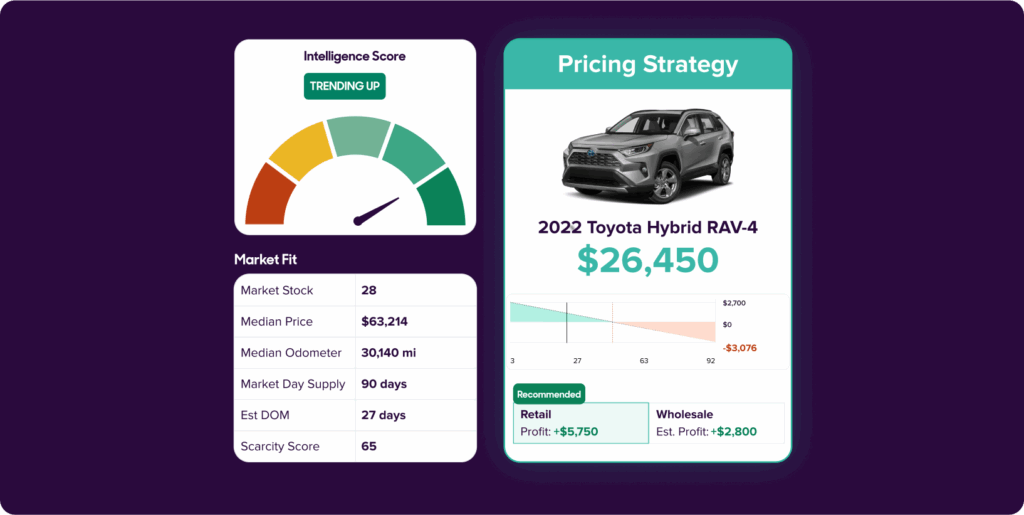

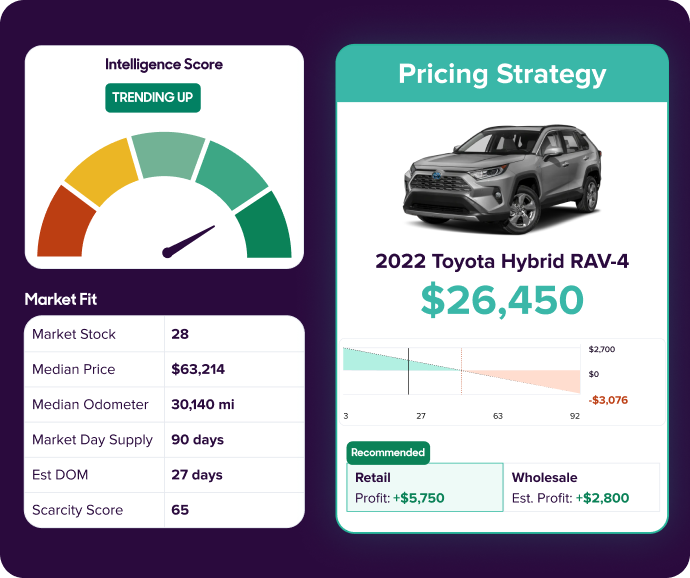

Winning dealers are creating simple risk categories and tracking weekly movement between buckets. To do this effectively, you need to understand what creates risk in the first place. Using vehicle, market, and dealer fit data can help you categorize each vehicle by risk.

- Vehicle Fit (Appeal in local market):

Does this vehicle match local buyer preferences?

- Mileage appropriate for market

- Desirable color for your area

- Popular options and features

- Clean vehicle history

- Market Fit (Supply and demand dynamics)

How saturated is the market with similar vehicles?

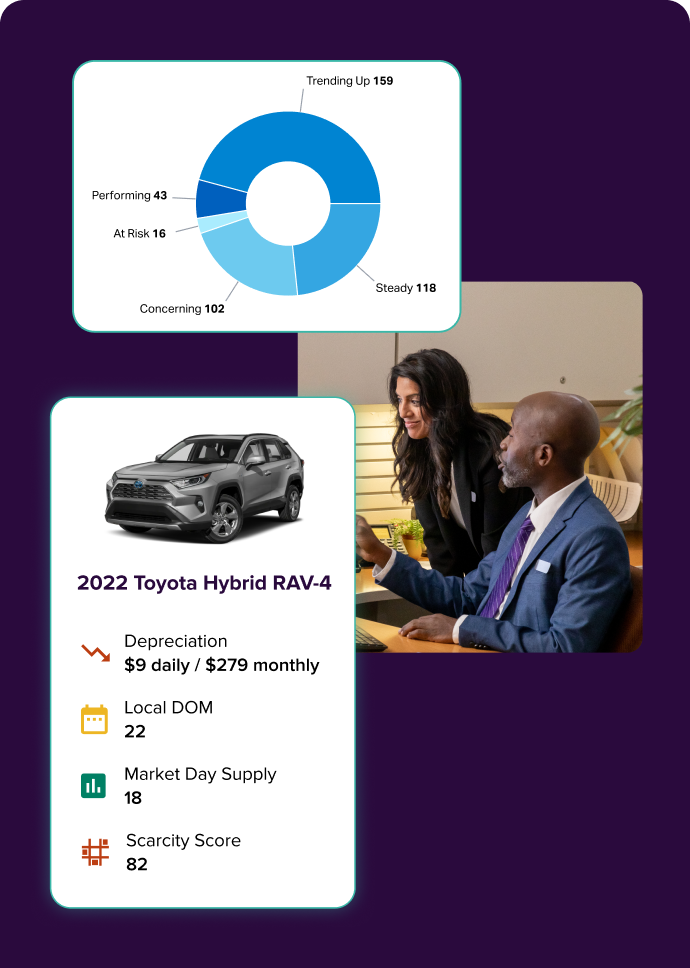

- Local Days on Market (DOM) – How long similar vehicles take to sell

- Market Day Supply (MDS) – Number of days of inventory available

- Dealer Fit (Your historical success)

How successful have you been selling this specific vehicle type?

- Current stock count of this make/model

- Sales history in last 90 days

- Turn time on similar vehicles

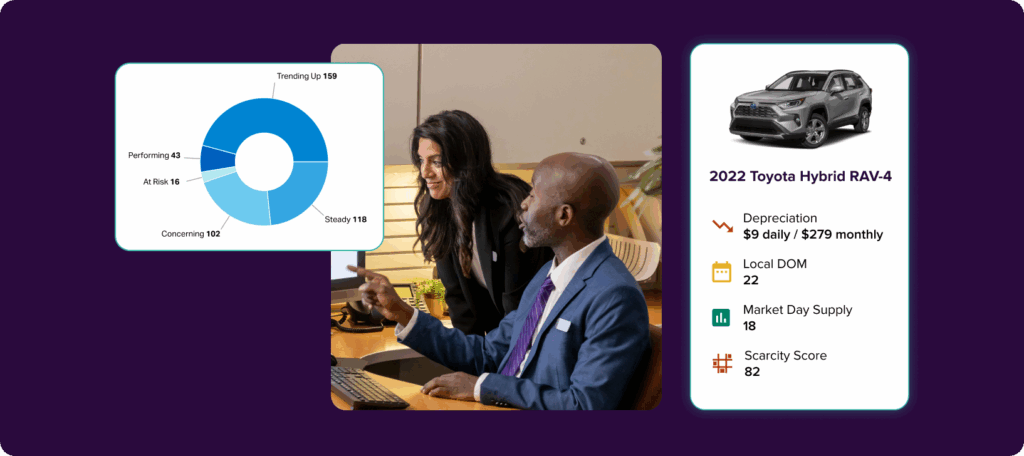

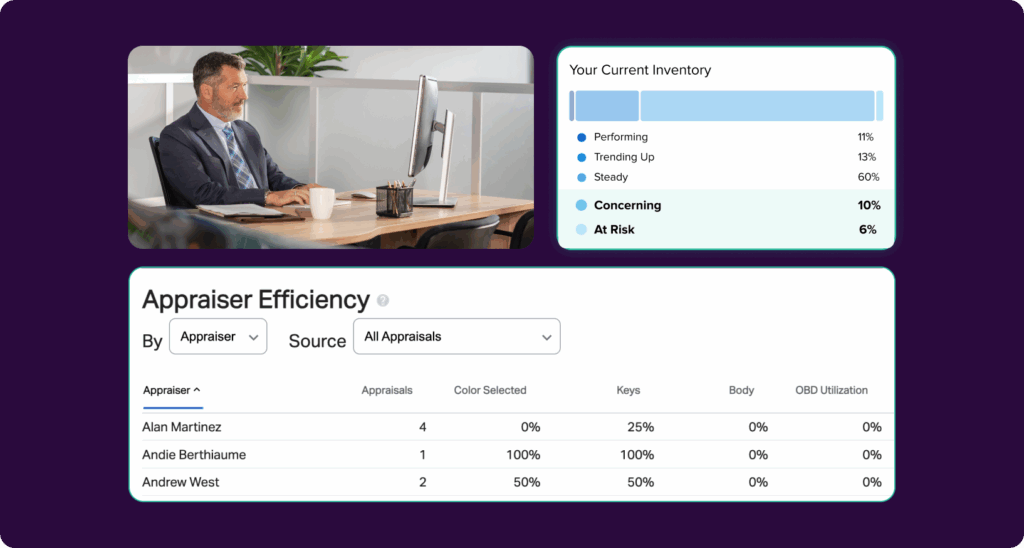

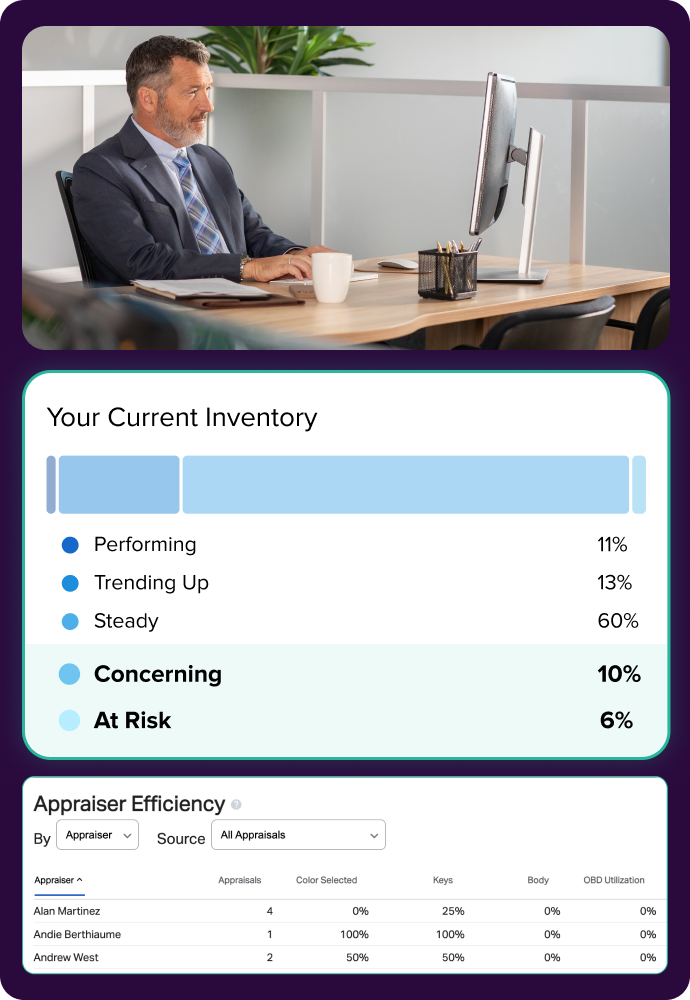

Pro tip: AccuTrade uses data in these three categories to separate inventory into five risk categories — At Risk, Concerning, Steady, Trending Up, and Performing — making it easy to determine risk for every vehicle on your lot.

Track acquisition-to-sale profitability, not just average days to turn. A vehicle that sits for 60 days but delivers $3,000 in front-end gross is a better outcome than one that turns in 30 days at breakeven.

Start measuring the full picture:

- What did you pay?

- What did you spend on recon?

- What did it sell for?

- What was your actual front-end gross after all costs?

This is where VIN-level data becomes essential. You need visibility into projected profit for retail versus wholesale scenarios so you can make smarter exit decisions based on actual market data rather than arbitrary age thresholds. Tools that show you real-time comps, local demand signals, and wholesale floor values help you make these calls with confidence.

AccuTrade’s Pricing Strategy tools are built specifically for this, showing side-by-side retail and wholesale projections with current market data.

Recognize and incentivize behaviors that improve front-end gross and reduce depreciation loss. When your team knows they’re being measured on profitability — not just speed — they’ll make decisions that align with your dealership’s financial goals. Track which buyers and managers are consistently making smart acquisition decisions. Who’s bringing in vehicles that sell quickly at full gross? Who’s catching recon issues early? Celebrate those wins publicly.

Process: Turn data into consistent, repeatable results

Consistency is what transforms insight into profit. The most successful dealers don’t just have access to better data — they’ve built disciplined processes around it. Making complete appraisals the standard, reviewing your inventory risk profile daily, and refining your process based on the most profitable outcomes gives you a key advantage over your competitors.

Every appraisal should start from the same foundation: VIN-level condition data, current local market comps, and realistic recon projections. Create a simple checklist your team follows every time. History report? Check. Diagnostic scan? Check. Current local wholesale comps? Check. Photos documenting condition? Check.

AccuTrade’s Appraiser Efficiency report helps standardize the valuation process by tracking appraisal rates for every appraiser across 13 different categories, including:

- OBD scanner utilization

- Color selection

- Body damage

- 11+ Photos

- Number of keys

- Look to book

When every appraisal uses the same criteria, you eliminate the guesswork and inconsistency that leads to bad acquisitions. Your team can acquire inventory with confidence because they know exactly what they’re buying and what it’s worth.

Implement daily risk-review sessions to ensure pricing and stocking decisions align with your plan. This doesn’t need to be a long meeting — focusing on vehicles that need immediate attention for 15 minutes each morning can prevent thousands in depreciation losses.

Pull up your inventory dashboard and ask questions like:

- Which vehicles moved into higher-risk categories overnight?

- Did local supply increase?

- Did recon take longer than expected?

- Did we miss the market on price?

From here, you can assign clear action items like:

- Adjust pricing

- Move to wholesale

- Add incentives

The discipline of daily review creates a culture of proactive management rather than reactive scrambling.

Document outcomes from each acquisition to continuously refine your buy- and sell-side strategies. Did that vehicle with high consumer interest sell quickly at asking price? Did the unit with diagnostic issues take longer to recondition than expected? Create a simple feedback loop where your team reviews what actually happened versus what you projected.

This is how you get better over time. Maybe you discover you’re consistently underestimating recon costs on trucks over 100K miles. Or that SUVs in a certain price range are moving faster than your data suggested. These insights compound — each transaction makes your next decision smarter. Good inventory management systems make this analysis easy with reporting that tracks actual performance against initial projections.

Transform your inventory strategy with complete visibility

The shift from age-based to risk-based inventory management is essential for protecting margin in 2026. But making that shift requires more than good intentions. You need the right data, the right processes, and the right tools working together.

AccuTrade’s complete inventory management system provides the foundation to execute this strategy: real-time market data that updates daily, VIN-level risk scoring across your entire lot, predictive analytics for smarter exit decisions, and comprehensive reporting that tracks what’s actually driving profitability.

When you can see which vehicles are trending into risk categories before they hit traditional “aged” thresholds, you gain weeks of decision-making advantage. That’s the difference between proactive pricing adjustments and reactive markdowns that destroy gross.

Ready to manage your inventory smarter?

Let’s walk through your current inventory together and show

you exactly where you’re leaving money on the table.

1 Cars Commerce Industry Insights Report, Q3 2025